Today Peab is a community builder that, through four collaborating business areas and local presence, is active throughout the Nordic region. Our business model provides us with unique opportunities to, with our own resources and control over the entire value chain, meet our customers’ needs and the expectations of the world around us.

In order to further promote value creation Peab externally reports the performance of the business by monitoring nine targets, of which three are financial.

The financial targets are:

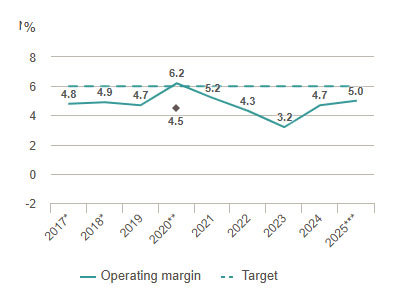

- Operating margin > 6 %

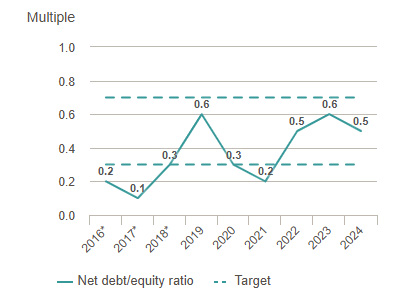

- Net debt/equity ratio 0.3 – 0.7

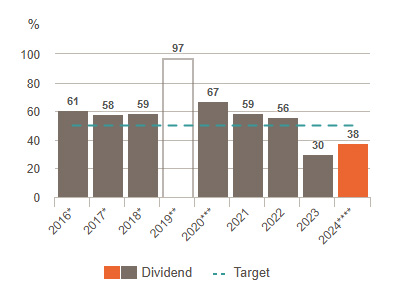

- Dividend > 50 % of profit for the year

Our financial targets are based on segment reporting and are valid over time and for a normal business cycle.

Operative operating margin over six percent

Peab’s profitability target is based on Peab’s structure after the acquisition in Industry and distribution of Annehem Fastigheter (investments in business areas Industry and Project Development). It is also based on a continuation of the work in recent years regarding stabilizing and strengthening the operating margin.

* Years 2017-2018 not translated according to changed accounting principles for own housing development projects.

**Operating margin 4.5 % excl. the effect of the distribution of Annehem Fastigheter (SEK 952 million).

*** Operating margin 2.5 % excl. Mall of Scandinavia (SEK 400 million).

**** Calculated on rolling 12 month per March 31, 2025.

Net debt/equity ratio within the interval 0.3-0.7

Peab has a strong financial position within this interval which gives us flexibility and maneuvering room to make the right deals at the right time. These will be investments that provide the conditions to sustainably achieve our margin target.

* Years 2017-2018 not translated according to changed accounting principles for own housing development projects.

** Per March 31, 2025.

Dividend: > 50% of profit for the year

With our margin target, stable profit and net debt within the interval 0.3 - 0.7 Peab will be able to distribute more than 50 percent of profit for the year to shareholders.

* Years 2016-2018 not translated according to changed accounting principles.

** For 2019, no cash dividend has been paid. The value of the distribution of Annehem Fastigheter at the time of the distribution in December 2020 amounted to 97 percent of the profit for the year 2019.

*** The proportion is calulated without the effect of SEK 952 million on profit due to the distribution of Annehem Fastigheter.